Interpreting how the market will react to any move is hard enough, but its behaviour in the wake of the recent downgrades can seem counter-intuitive. One needs to understand the complexities in order to make wise investment decisions in uncertain times.

By Roland Olivier, analyst at Cinnabar Asset Management

One might expect that the downgrade of a country’s sovereign debt would result in the devaluation of its currency, cause its stock market to tumble and provoke an interest rate hike. But often this is not the case, and South Africa is a case in point.

Given that the ability to predict what markets will do in the future is critical to success, how does one explain this apparently illogical market behaviour?

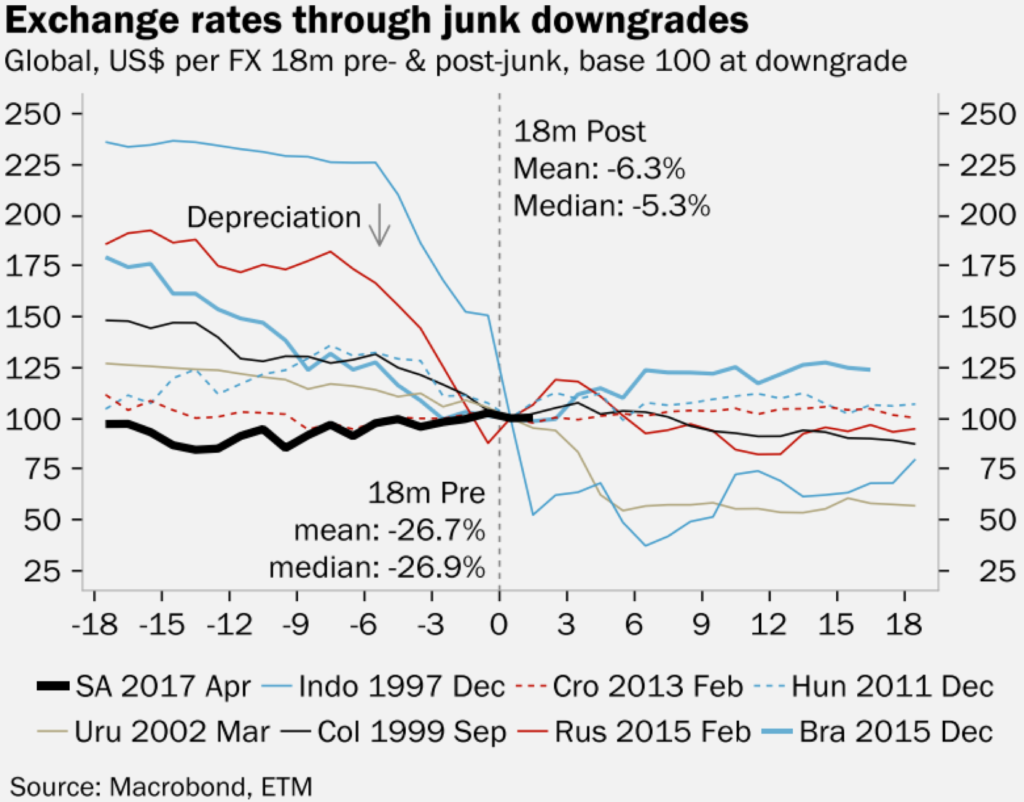

It’s actually rather common for markets to strengthen after a downgrade—the same thing happened in Brazil, for example. The reason for this is a market downgrade does not come out of the blue: it’s usually a lengthy process with many signposts along the way. Accordingly, the market will price the downgrade into equity and bond indices, and the currency, in tandem. Then, if the final blow the downgrade is actually struck, certainty returns to the market and it starts to begin moving in an upward direction.

This is what happened in the case of South Africa. As the diagram below shows, the rand strengthened against the dollar by 4.7 percent, while the All Share Index (ALSI) (total return) and All Bond Index flicked up by 1.4% and 3.5% respectively (7 April to 31 May 2017).

By contrast, Nenegate, the summary dismissal of the then-Minister of Finance, Nonhlanhla Nene, was completely unexpected, and it prompted a dramatic drop in the currency as well as both indices.

Once one has understood these dynamics, an investor might well ask why, if the ALSI has moved higher since the downgrade, some South African funds are not performing well.

To answer this question one has to understand the complex set of factors that a portfolio manager (or any other investor, for that matter) makes when constructing a portfolio. In each case, the guiding principle is his or her fundamental view about where markets are headed. As always, there is a large disparity of views—something that is necessary to make a market.

Currently, international investors are driving emerging markets higher as they search for good returns. China is by far the largest emerging market, and investors believe it is basically stable and holds little risk. All the emerging markets benefit from this perception, South Africa included.

One should add that we look quite a bit better than the likes of Russia, Turkey and Brazil, even with the volatile political situation. As a result, our currency and equity and bond markets are strong.

However, if one looks at the ALSI returns for the year to date, it becomes apparent that this strength is derived almost wholly from the rand-hedge stocks; that is, those that are also listed on an exchange in one of the developed markets, and that derive the majority of their revenue outside South Africa.

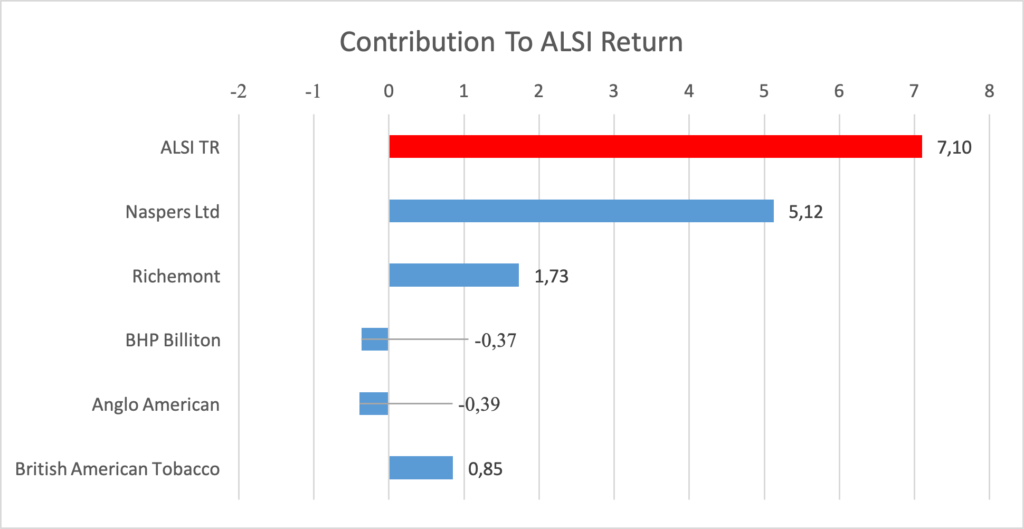

The graph below illustrates the returns of the five largest stocks in the All Share Index as of 31 May 2017.

What’s worth noting is that these five companies contributed 6.95 percent of the 7.1 percent return of the ALSI as a whole. If one excludes the two resource counters, Naspers, Richemont and British American Tobacco, which make up 26 percent of the ALSI, returned 7.7 percent—meaning the rest of the market actually showed negative growth of -0.6%.

In other words, a portfolio manager who is not holding these three stocks is making a large bet against the market—a bet that has not paid off, as yet at any rate. Such a portfolio is thus performing less well than ones that do hold these three.

This decision is based on the portfolio manager’s long-term view about the market and, in this case, the currency. He or she might be concerned that the currency will appreciate yet more, enough to reduce the high earnings of the rand hedges, at least a proportion of which can be ascribed to the fact that the rand is still weak relative to the currency in which earnings are paid.

However, rand hedges like Naspers may show such strong growth that it would take a massive appreciation of the rand to eliminate their positive contribution to the portfolio.

In the end, then, it boils down to whether the portfolio manager is bullish about the currency or not. Both views have merit, and our portfolios include managers with both views.

ENDS.

Sources: Focus Economics, Trading Economics, ETM Analytics, Macrobond, Fidelity International, Cinnabar Investment Management, Bureau for Economic Research, SA Reserve Bank, Financial Times

About Cinnabar Investment Management

Cinnabar Investment Management is a Discretionary Fund Manager helping local and global clients create a world of success by making better investment decisions.

Contact details

Cinnabar Investment Management

Alex Funk

CEO

Tel: 011 768 1022Email: info@cinnabarim.co.za